We are all guilty of getting sucked into a sale or purchasing something we probably could’ve gone without. But in that moment of time we know it is wrong, but that rose quartz drink bottle to positively charge your water, just felt so right.

At a time when many retailers are aiming to boost online sales with the availability of more buy-now-pay-later (BNPL) deals such as Klarna, Afterpay etc, our latest research shows that nearly three in five (58%) 18 to 24-year-olds have experienced issues keeping up with repayments. We understand that BNPL can be a useful tool to spread the cost of those big-ticket items. However, being able to buy almost anything, without any initial payment from the buyer, can cause people to rack up monthly repayments, across multiple purchases, that they struggle to repay and ultimately enter the dreaded debt spiral.

57 per cent (of 18-24-year-olds) feel buy-now-pay-later schemes encourage them to spend more money than they have.

️ 42 per cent say BNPL encourage them to buy more than what they need to. Further, nearly half (48%) think they encourage them to buy things that they don’t really want upon later reflection. Rose quartz drink bottle, cough cough.

59 per cent of those aged between 18 and 24 say they have ‘regularly’ or ‘more than once’ applied for high-cost credit (such as buy-now-pay-later schemes, credit cards, overdrafts or payday loans) knowing they’d struggle with repayments but felt they had no other choice. This compares to the 37 per cent average across all ages.

When asked why Brits need to access high-cost credit, over half (53%) of the young and working said it was to pay for everyday expenditure – to bridge the time to when they get paid.

Well, over half (55%) of 18 to 24-year-olds – the greatest proportion of any age demographic – would like to be paid more frequently in order to have increased control over their finances.

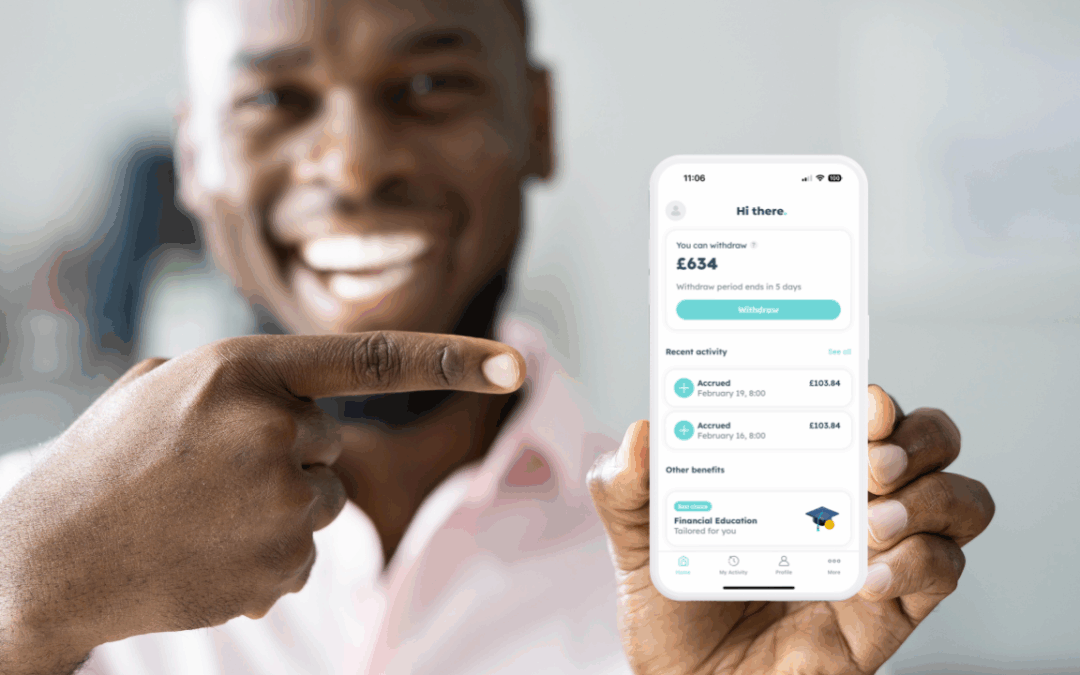

While BNPL can be an effective means to grab a great deal, it can also have a really negative effect on a person’s financial health if they were to fall behind with the repayments. In order to help, employers should be considering ways in which they can reduce the employee belief that they “have no other choice” but to opt for borrowing. Earnings on demand (or Earned Wage Access as it is called in The States) gives employees greater visibility and ownership of their money, and such tools are often free to the employer, require minimal time and effort to integrate with existing payroll systems and do not impact cash flow.

At a time where financial concerns are heightened, employers stepping in to give staff access to their money as they earn it can make all the difference, relieving poor financial habits that soon become impossible to break free from.

Find out more about Hastee here.